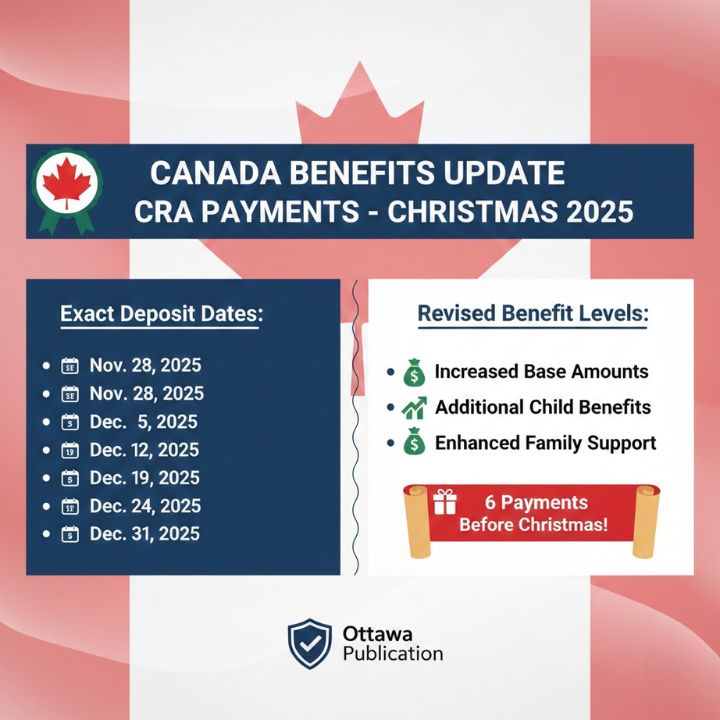

As Christmas 2025 gets closer millions of Canadians are getting ready for one of the busiest and most costly times of the year. Higher holiday expenses along with colder weather & extra year-end costs make December a particularly challenging month for families nationwide. The Canada Revenue Agency helps reduce this financial strain by scheduling several important direct deposit payments before Christmas to ensure that qualified people and families get support when they need it most. These payments arriving before the holidays include the GST/HST Credit and Canada Child Benefit along with the Climate Action Incentive & Disability Tax Credit adjustments and provincial supplements. When Canadians know the exact payment dates and understand who qualifies they can plan their budgets more effectively and face the holiday season with less financial stress. This article covers each of the six CRA direct deposit payments coming before Christmas 2025 & explains when they will arrive and who can receive them and how much money recipients should expect.

Understanding CRA Direct Deposit Payments Before Christmas

The CRA’s holiday payment schedule helps Canadians manage their expenses as the year comes to a close. December brings higher costs for most families including groceries and gifts along with transportation and heating bills and winter clothing. Parents also deal with extra expenses when schools close for the holidays or children attend special programs. The CRA organizes several federal programs to send out payments before December 25 so people have money when they need it most. Using direct deposit makes everything faster and more reliable since winter storms can delay mail delivery. This system gives Canadians a secure way to receive their funds on time without worrying about lost cheques or postal delays. These scheduled payments provide predictable support during a season when budgets are already stretched thin. Families can plan their spending better when they know exactly when money will arrive in their accounts. The advance timing of these deposits recognizes that holiday expenses start well before Christmas Day itself.

Why These Payments Matter During the Holiday Season

For many households CRA benefits are more than just support because they are essential income streams. The added financial cushion helps people manage budget fluctuations and prevents debt accumulation while providing peace of mind during a month when spending often increases. These payments are designed to support vulnerable groups including families with children & seniors along with low-income and moderate-income households. People with disabilities also receive support as do residents in qualifying provinces receiving climate rebates. By receiving payments before Christmas Canadians have time to prepare for holiday expenses rather than scrambling financially at the last minute.

Major CRA Holiday Payments Issued Before Christmas 2025

| Payment Category | Scheduled Payment Date | Who Is Eligible | Estimated Support Amount |

|---|---|---|---|

| GST / HST Credit | 5 December 2025 | Low- and middle-income individuals and households | $100 – $300 |

| Canada Child Benefit (CCB) | 20 December 2025 | Parents or guardians of eligible dependent children | $350 – $750 per child (average estimate) |

| Climate Action Incentive Payment | 13 December 2025 | Residents of participating provinces | $250 – $500 |

| Disability Benefit Top-Up | 18 December 2025 | Recipients approved under the Disability Tax Credit | Amount varies by individual eligibility |

| Provincial Benefit Supplements | 15–22 December 2025 | Eligible residents under province-specific programs | Varies by province |

GST/HST Credit: Early December Support for Lower-Income Canadians

What the GST/HST Credit Is

The GST/HST Credit is a quarterly federal benefit that helps lower-income individuals & families manage the cost of sales tax. The payment is completely tax-free and gets deposited directly into the bank accounts of people who qualify.

Estimated December 2025 Payment Amounts

The payment amount depends on your income level and whether you are married or single and how many children you have. For December 2025 most recipients will receive somewhere between $100 & $300 for the quarter. This payment typically arrives in the first few days of the month and gives people extra money right before holiday expenses start adding up.

Who Qualifies

The Canada Revenue Agency looks at your previous year’s tax return to decide if you qualify. You need to meet several basic requirements including filing your tax return on time and having an income below certain thresholds set by the CRA. Your residency status also matters and you may receive more if you have eligible dependents. This payment represents an important source of financial support heading into the holiday season.

Canada Child Benefit: Key Year-End Support for Families

Canada Child Benefit December 2025 Payment The Canada Child Benefit helps parents and guardians cover expenses for raising children under 18 years old. Families receive monthly payments that are not taxed by the government. The December payment becomes particularly important because families face higher costs during the holidays for childcare and gifts and food. Payment Schedule and Expected Amounts Families should expect their December 2025 CCB payment to arrive on December 20 2025. Most eligible families will receive between $350 & $750 for each child. The exact amount depends on household income & the age of each child. Requirements for Eligibility Parents need to meet several basic requirements to get CCB payments. They must file their tax returns every year even if they have no income to report. The child must be under 18 years old and living in the same home. Parents must be the main caregivers responsible for daily care and upbringing. They also need to meet the standard residency requirements set by the federal government. The Canada Child Benefit represents one of the largest federal support programs for families at the end of each year. Many parents rely on this payment to manage their household budgets and provide for their children throughout the month.

Climate Action Incentive: Supporting Canadians Ahead of Cold Weather

Purpose of the Climate Action Incentive

The Climate Action Incentive is a refundable credit given to people living in provinces that use the federal carbon pricing system. The payments help cover increased costs for fuel and home heating during winter months.

Expected December 2025 Payment

The CAI deposit will arrive on December 17 2025. Estimated amounts range from $250 to $500 based on your province and how many people live in your household.

Who Receives CAI Payments

Residents of eligible provinces get the CAI automatically if they filed a tax return & lived in a province using the federal carbon pricing system. You must be 19 years or older unless you meet specific rules for younger recipients. This payment offers valuable support for energy costs right before the coldest part of winter begins.

Disability Benefit Adjustments: Additional Year-End Support for Eligible Canadians

What This Adjustment Covers People who have approval for the Disability Tax Credit (DTC) might get adjustments or payments for past periods in December. These payments happen because of changes in how benefits are calculated or approvals that apply to earlier years or regular yearly reviews. December 2025 Payment Date The CRA plans to send out disability-related adjustments on December 18 2025. The payment amount is different for each person and depends on their tax situation. Who Can Get These Payments To receive this money you need to have an approved Disability Tax Credit certificate & you must file your taxes every year & meet the medical requirements that CRA has set. These payments can really help Canadians who are dealing with costs related to their disability during the holiday season.

Provincial Supplements: Region-Specific Holiday Assistance

Beyond federal benefits several provinces provide extra payments or top-ups. The CRA system handles these payments and they may include:

Cost of living payments Provincial child benefits Seniors’ benefits Housing or energy rebates

December 2025 Payment Window

Provincial payments should arrive between December 17 & December 22 in 2025. The amounts differ depending on your province and the specific program. This means deposit values can vary quite a bit.

Who Qualifies

Each province sets its own eligibility rules. They typically look at: Family size Income Disability status Residency rules These extra payments often help residents manage increased winter costs at the end of the year.

Why CRA Holiday Payments Are Essential for Canadians

December puts a heavy financial burden on most families. Heating bills go up while holiday meals and gifts add to the costs. Many people also spend more on transportation during this time. CRA holiday payments give Canadians important support. The money helps families stay out of debt and cover their increased utility bills. It also makes it easier to pay for childcare & travel while preparing for family gatherings. These payments help millions of people create a more stable budget during the holiday season. Direct deposit makes sure people get their money quickly & reliably. Winter weather often causes mail delays so the CRA uses direct deposit as the main payment method for most benefits. This approach prevents cheques from arriving late and keeps the money secure. People receive their funds instantly on the scheduled payment day. Canadians who use direct deposit can check their accounts and know exactly when their support will arrive.

Preparing for CRA Payments Before Christmas 2025

To ensure smooth and timely receipt of December benefits Canadians should file their taxes every year and keep their CRA account information current. It helps to monitor direct deposit details and track expected payment dates. People should also check their eligibility after major life changes like moving or having a baby or experiencing income changes. Staying informed helps individuals get the most from the financial support available to them.

Final Thoughts: Entering the 2025 Holiday Season with Better Financial Confidence

As Christmas nears in 2025 the CRA’s direct deposit schedule offers important help to Canadians. Several payments will arrive during December to help people and families handle increased holiday costs and reduce money worries during the festive season. Canadians should learn about the available benefits and check if they qualify for them. They should also keep track of when deposits will arrive in their accounts. This helps ensure they get all the money they deserve before Christmas. These December payments help millions of people across Canada deal with end-of-year expenses more easily & with less financial stress.