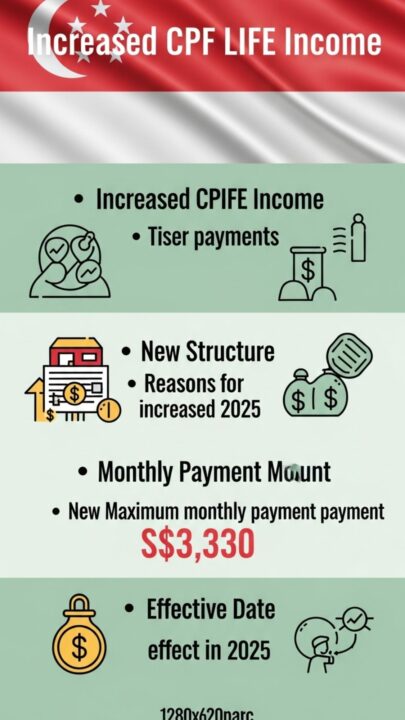

The Central Provident Fund LIFE scheme continues to be a vital component of retirement planning for Singaporeans. Eligible retirees in 2025 can receive monthly payments reaching up to S$3330 to provide steady income over the long term. This program ensures that senior citizens in Singapore maintain regular financial support throughout their retirement years for daily living expenses and healthcare needs. The 2025 revisions to CPF LIFE aim to improve accessibility and benefits for individuals who are beginning their retirement in Singapore.

CPF LIFE 2025 Payout Explained — Higher Monthly Income with Payments Rising Up to S$3,330

The revised CPF LIFE 2025 program works to strengthen retirement support for elderly Singaporeans through higher monthly payouts and expanded plan options. Eligible members can receive monthly payments reaching S$3330 depending on their accumulated savings and chosen plan type. The updates address rising costs & inflation by delivering consistent financial support to retirees. These modifications reflect Singapore’s ongoing dedication to maintaining a viable pension framework that ensures seniors enjoy financial security throughout their retirement years.

CPF LIFE Eligibility in 2025 — Who Gets Covered, Age Rules, and Automatic Enrollment Details

To be eligible for CPF LIFE in 2025 you must be a Singapore Citizen or Permanent Resident aged 65 or above with sufficient funds in your Retirement Account. You can choose the Standard Plan for higher monthly payouts or the Basic Plan for lower payouts that allow you to pass on more savings to your beneficiaries. Enrollment happens automatically for those who meet the requirements so there is no need to submit an application. The scheme ensures that Singaporeans receive consistent financial support during their retirement.

How the Enhanced CPF LIFE Structure in 2025 Affects Retirees — Benefits, Adjustments, and Key Considerations

CPF LIFE 2025 marks an important step forward in securing retirement income for Singapore’s growing elderly population. The higher payouts help retirees manage their everyday expenses more easily during times of rising costs. This change also means seniors can depend less on their families and maintain their financial independence. By providing better support to everyone who qualifies CPF LIFE serves as a key part of the country’s social security system & helps the government achieve its goal of making sure all senior citizens benefit from Singapore’s economic growth.

New Electricity Billing Starts December 2025 Prepaid Meter Readiness Checklist & Avoid Power Cutoffs

New Electricity Billing Starts December 2025 Prepaid Meter Readiness Checklist & Avoid Power Cutoffs

CPF LIFE 2025 Payment Increase — Essential Points Every Retiree Should Understand

CPF LIFE 2025 marks an important step forward in retirement planning for Singapore’s growing elderly population. The reform improves financial security by raising monthly payouts & expanding who can receive benefits. Automatic enrollment cuts through red tape and makes sure eligible citizens get their payments without needless waiting. The program tackles the challenge of people living longer by guaranteeing income for life after retirement. This helps retirees keep up their lifestyle without worrying about running out of money. The government built the system to stay financially sound while serving future generations. Singapore shows its commitment to supporting older citizens through careful policy changes. The program balances responsible spending with social support. CPF LIFE 2025 responds practically to the demographic shifts and economic conditions the nation faces. The reform updates existing systems while adding real improvements. Retirees can now plan their later years knowing more clearly what income they will have. This predictability improves quality of life & eases money worries among older Singaporeans.

| CPF LIFE Plan / Option | Estimated Monthly Payout (S$) | Eligibility / Start Age | Main Benefit |

|---|---|---|---|

| Standard Plan | Up to 3,330 | From 65 | Higher monthly income, smaller bequest |

| Basic Plan | Up to 2,800 | From 65 | Lower monthly income, larger bequest |

| Escalating Plan | Starts around 2,600 | From 65 | Payout increases by 2% each year |

| Retirement Account (RA) Top-Up | Depends on top-up amount | Typically 60–65 | Boosts lifelong payouts by increasing RA savings |

| Deferred Payout Start | Up to 3,600 | Start at 70 | Higher monthly payout when you delay the start |