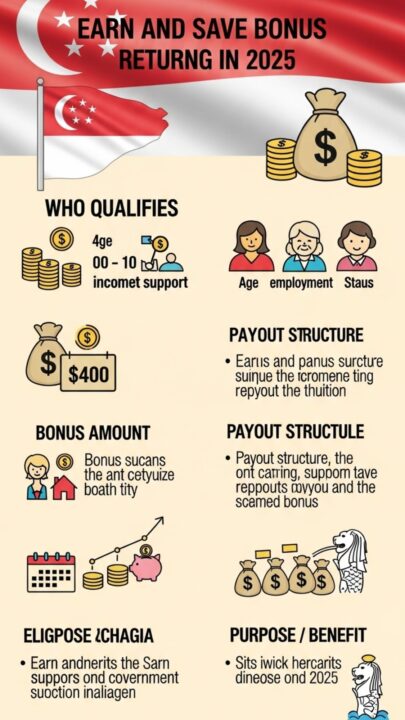

Think about it: you are dealing with rising grocery bills and utility costs & unexpected medical expenses while the global economy keeps changing and making your life harder. This was the reality for millions of Singaporeans at the start of 2025 but the government stepped in at the right time with a cash payout of $400. This measure was part of the 2025 budget and serves as both relief and a practical way to help people manage their struggles with inflation. The government used funds from the GST Voucher and Assurance Package to target the most affected people & demonstrated Singapore’s approach to proactive support. The distribution has been gradually wrapping up by December 2025 but many have already seen a positive impact.

Inside the Bonus Breakdown — What the $400 Support Really Includes

The government is responding to the sharp increase in prices for essential goods and services. Food costs have jumped 5% this year while transportation and utility bills have also climbed due to unstable energy markets. The $400 payment gives recipients the freedom to decide how to use it. They can buy groceries or pay for transportation or cover medical expenses. This one-time payment is part of a larger $10 billion support package that also includes CDC vouchers and additional MediSave funds for older residents. Direct cash payments allow people to make their own spending decisions rather than being limited by specific subsidies. This approach helps residents manage their finances better in an expensive city.

Eligibility Simplified — Who Actually Qualifies for the Earn and Save Bonus

The government has decided to act as prices for essential goods have increased substantially. Food costs have climbed 5% this year while transportation and utility expenses have also gone up due to ongoing energy market volatility. The $400 payment allows recipients to decide their own spending priorities. They can buy groceries or cover transport expenses or settle medical costs. This one-time payment forms part of a larger $10 billion assistance package that includes CDC vouchers and additional MediSave contributions for elderly residents. Providing direct cash transfers enables people to make their own purchasing decisions rather than limiting them to specific subsidies. This approach supports residents in managing their finances more efficiently in a city with elevated living expenses.

| Household Type | Income Range (Assessable) | Home Annual Value | Payout Amount |

|---|---|---|---|

| Lower-Income | Up to $34,000 | Up to $21,000 | $400 |

| Middle-Income | $34,001–$100,000 | $21,001–$31,000 | $200–$300 |

| Higher-Income | Over $100,000 | Over $31,000 | $0 |

Payment Flow Explained — When the Money Arrives and How It’s Credited

The government began distributing funds in early 2024 and most people received their payments during the second week of August. Currently over 80% of eligible recipients have received their money through PayNow linked to their NRIC GIRO or direct bank transfer. If you have not received your payment yet you should check your status through Singpass. The government sends updates by SMS to keep you informed. Be careful of scammers who are taking advantage of this situation. Only trust official communications from gov.sg websites & ignore any suspicious links that promise instant claims or immediate payments. Senior citizens aged 65 and older will receive additional benefits. They will get bonus top-ups of up to $300 credited to their MediSave accounts along with their cash payments. These additional payments for seniors are scheduled to be distributed in February 2025.

More Than Cash — The Wider Impact Beyond the One-Time Bonus

This cash payment shows how Singapore’s welfare system adapts to changing needs. It provides immediate relief while suggesting future support measures such as enhanced U-Save rebates or additional cash distributions in 2026. Many families report using the money for their children’s needs or to reduce debt & they express satisfaction with this assistance. Financial advisors suggest that combining these payments with budget planning tools can help create longer-term benefits. During times of economic uncertainty this payment serves as a clear example that government support should be viewed as an investment in shared prosperity rather than simple charity.